TeraWave — Why Does Jeff Bezos Need Another Satellite Network?

Blue Origin has announced a new satellite network called TeraWave. What is it? Why is it needed? Is it a competitor to Starlink and Amazon LEO?

On January 21, 2026, Blue Origin — founded by Jeff Bezos — officially presented the TeraWave project, a global-scale satellite communications network. At first glance, the news appears paradoxical: Bezos already has a satellite internet project, Project Kuiper, within Amazon, which was recently renamed Amazon LEO. Why launch another one?

To understand the logic behind TeraWave, it is important not to confuse satellite internet as a service with a satellite network as infrastructure. In public perception, these concepts are often merged into one, but in reality, the difference between them is similar to that between an apartment’s internet connection and the backbone links that connect continents. Amazon LEO (Project Kuiper) is being built specifically as an access system — a way to connect users where terrestrial networks are unavailable or unstable. TeraWave, by contrast, was conceived from the outset as something different: an ultra-powerful space-based backbone capable of transporting enormous volumes of data between key nodes of the global digital infrastructure.

Understanding the logic of TeraWave becomes easier if one looks carefully not only at the numbers, but also at the purpose, architecture, and strategic context of the project.

What Is TeraWave?

According to information published on the Blue Origin website, TeraWave is a space-based communications network designed to provide symmetric data transmission capacity of up to 6 terabits per second (Tbps) and to enable high-speed access to this backbone from anywhere on the planet.

Known key characteristics include:

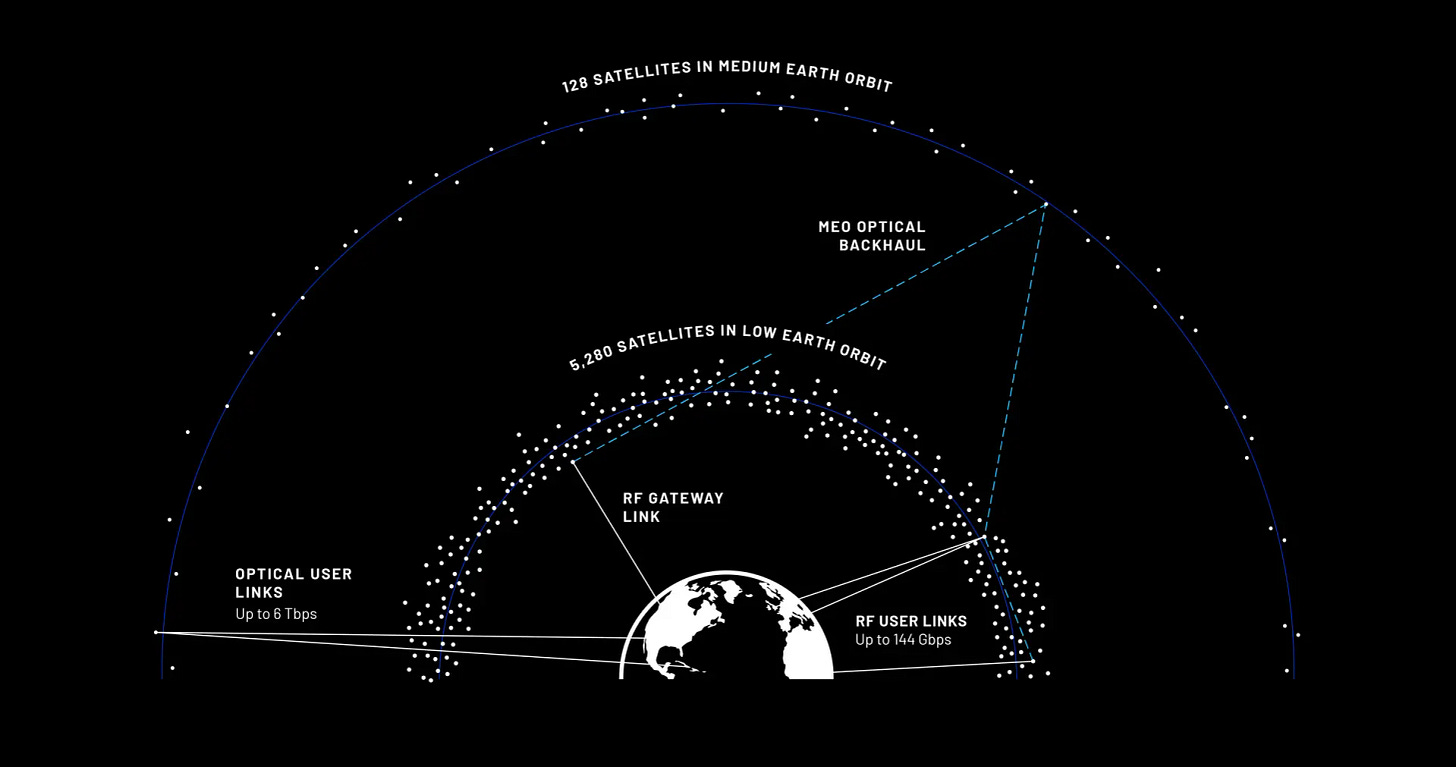

Architecture: 5,408 satellites integrated into an optically interconnected network (ISL), operating across two orbital layers — low Earth orbit (LEO) and medium Earth orbit (MEO).

5,280 satellites in LEO to provide user connectivity.

128 MEO satellites providing ultra-high-capacity optical inter-satellite links (ISL).

To ensure high-speed connections between ground terminals and satellites, the Q and V frequency bands will be used, enabling throughput of up to 144 Gbps for customer connections.

The start of network deployment has been announced for the fourth quarter of 2027.

How Does TeraWave Differ from Starlink and Amazon LEO?

The experience of deploying Starlink, and especially the technical failures inherent in rapid large-scale deployment, has demonstrated the downsides of combining end-user access networks with backbone communications channels. Simply put, when something goes wrong, everything breaks.

For this reason, TeraWave is not, in essence, a direct competitor to Starlink, Amazon LEO, or similar projects. Rather, it is an attempt to “stake out” the niche of a space-based “provider for providers.”

The use of the Q and V bands, which some other projects — including Chinese mega-constellations — are already experimenting with, provides the technical capability for ultra-fast links between terminals and satellites. However, these will not be compact, lightweight mobile satellite terminals, but rather high-tech, high-power “air heaters,” which will also be quite sensitive to atmospheric interference.

Recent technological advances in optical laser communications allow TeraWave not only to form a reliable high-speed optical network between satellites in MEO and LEO (ISL). They also open the possibility of using laser links for ground-to-space communications with similarly very high throughput. Somewhere nearby lies the same market niche that SpaceX is already targeting — optical laser communications services for third-party near-Earth satellites.

All of the above immediately provides an understanding of why this is a separate project within Jeff Bezos’s private company rather than part of Amazon LEO’s plans. Clearly, there are strategic and technical objectives here that differ significantly from those of Amazon LEO. And putting all eggs in one basket, as SpaceX is currently doing, is something Bezos is clearly not planning to do.

There is also another, fairly critical aspect. Starlink truly “broke open” the SatCom market and effectively introduced an explosive everyday demand for mobile satellite connectivity available anywhere and anytime. However, several ill-considered decisions by Elon Musk simultaneously created enormous demand for the sovereignty of such connectivity. As a result, the number of LEO SatCom constellation projects is currently growing like mushrooms after rain.

The market niche of a space-based “provider for providers” currently looks very promising. For many satellite projects, such a service would be a very convenient way to save on the development of their own ground infrastructure, among other things.

Jeff Bezos has repeatedly demonstrated not only an ability to achieve commercial success, but also an ability to learn from others’ mistakes. From this perspective, the TeraWave project looks very promising.

Are There Any Pitfalls?

Despite all its promise, TeraWave does have some “bottlenecks.” Production volumes for satellites, their components, and terminals for such ultra-fast connections can be considered achievable — Jeff Bezos’s team already has some experience in this area. However, certain technical challenges still remain. And with them, risks.

The main and most difficult limiting factor for TeraWave, however, is and remains launch transportation. Blue Origin still does not look like a company capable of rapidly achieving the required cadence of satellite deliveries to orbit “like buses on a schedule,” as SpaceX already does. It is also worth recalling that the launch schedule for Amazon LEO satellites still requires intensification and scaling. Therefore, the question “By whom, how, and when will those 5,408 satellites be delivered to orbit?” remains very much open.

SkyLinker will closely monitor the development of the TeraWave project and, of course, will not leave its subscribers without fresh and up-to-date information and analysis about it.

The support of paid subscribers of SkyLinker.io will allow us to share even better and even more independent analytics, interesting reviews, and produce training and educational materials. From an inexpensive subscription costing a few cups of coffee per month to a more significant “Patron” level — all of this is clearly and qualitatively converted into information and knowledge, primarily for the defenders of Ukraine.

All the most interesting things from the world of communication and space technologies are also available in the form of educational audio podcasts and video lectures both on the website and on the SkyLinker Youtube channel.